Homes Sold and Their Average Sales Price in Sacramento

After reading the national numbers posted by CoreLogic, I spent time reviewing our local Sacramento area numbers. The data shows us that since March when the stay-at-home orders began, sellers have slowed the supply side significantly. The unemployment rate for Sacramento County was at 14.7% in April. And yet there is so much pent-up buyer demand that sales prices have continued to climb higher.

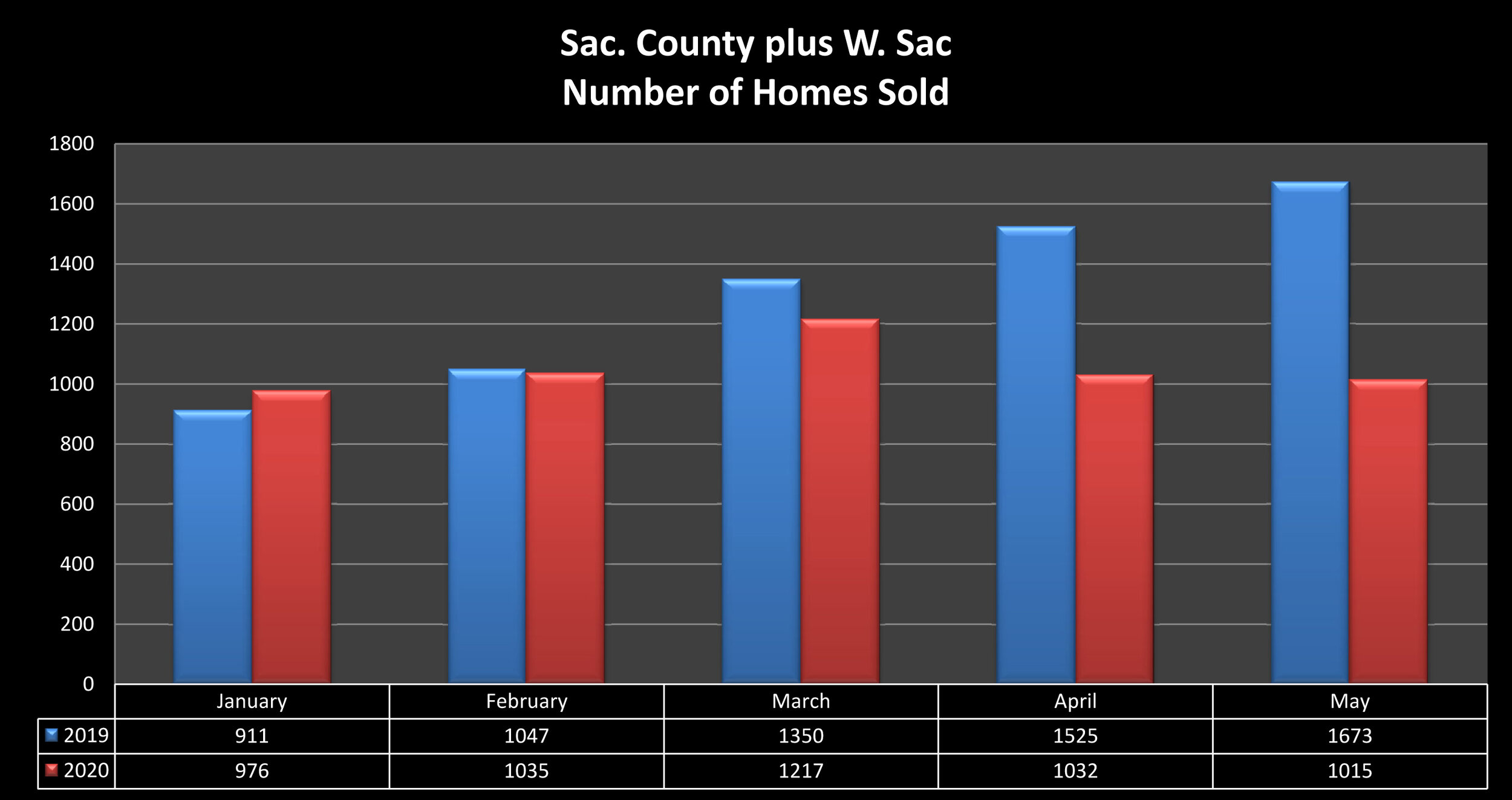

Looking at numbers in February of this year when compared to 2019 showed that we were on a faster sales pace year over year. At the end of February 2020 there had been 2011 sold houses in the Sacramento County plus West Sacramento region. Compare that to the 2019 numbers where we had only seen 1,958 sold houses in that same time period. But those sales numbers began to decline in March and then dropped significantly in April and May. For the months of April and May in 2019 there were 3,198 houses sold in the region, but in 2020 the sales numbers dropped by more than a thousand in those two months. April and May of this year saw only 2,047 houses sold.

While the total number of sales has declined significantly due to the coronavirus pandemic, the average sales price has gone up by about 5%. The average sales price through May in 2019 was $407,444 and the average sales price through May of this year is $427,845. The combination of appreciating home values and very low interest rates (they’ve been in the low 3s and high 2s) have been significant contributors to the career years that many loan officers in region have been experiencing. Existing home owners have been wise to refinance their mortgages. Will this benefit the long term health of the real estate market? Or will the large number of refinances result in a continued reduction in the housing supply? I have not yet seen any studies nor reports on how these large number of households reducing their monthly expenses will benefit the overall economic health of our region but I imagine that it will.

For me, the long term picture remains blurry. On the side indicating that home values will continue to go up are a lack of supply, low interest rates, and so far a large and fully capable buyer pool. On the side indicating that there will be a decrease in home values are the current high rate of unemployment and the projected increase to unemployment due to budget cuts at the state and local level in government and in education. Those unemployment numbers can eventually cut into the pool of capable buyers. If that plays out, then we will see a significant decrease in demand. Low demand and low supply could indicate a plateauing of values on the horizon. Because the stock market has seen such a sharp and sudden recovery from the pandemic caused declines, I estimate that the real estate market will continue on its upward trend with a possible plateauing in 3-6 months. But I will continue to monitor market data month over month and update accordingly.